Ep. 161 The Huge Problem the Fed Caused When It, Ahem, Solved the Last Problem

Play

Stop

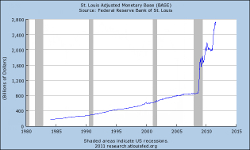

During and after the financial crisis the Fed increased the monetary base to an unprecedented extent. Everyone hailed it for its wisdom. but that alleged solution is now a major problem hanging over the economy. What if anything can the Fed do now?

During and after the financial crisis the Fed increased the monetary base to an unprecedented extent. Everyone hailed it for its wisdom. but that alleged solution is now a major problem hanging over the economy. What if anything can the Fed do now?

Related Articles

“Dudley’s Defense of the Fed’s Floor System,” by George Selgin

“Three Flawed Fed Exit Options,” by Bob Murphy

Book Mentioned

How Privatized Banking Really Works – Integrating Austrian Economics with the Infinite Banking Concept, by Bob Murphy and Carlos Lara

Bob’s Latest Book

Contra Krugman: Smashing the Errors of America’s Most Famous Keynesian

Need More Episodes?

Tom and Bob have their own podcasts! Check out the Tom Woods Show and the Lara-Murphy Report.