Ep. 64 Why It’s Impossible to Keep Only the “Good Parts” of Obamacare

Play

Stop

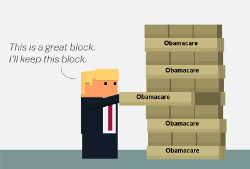

Let’s keep the part about covering pre-existing conditions, say Donald Trump and many other Republicans, and just get rid of the parts we dislike. Unfortunately for them, that can’t be done.

Let’s keep the part about covering pre-existing conditions, say Donald Trump and many other Republicans, and just get rid of the parts we dislike. Unfortunately for them, that can’t be done.

Krugman Column

“The Art of the Scam” (December 5, 2016)

Book Mentioned

The Primal Prescription: Surviving the “Sick Care” Sinkhole by Doug McGuff, MD and Robert P. Murphy, PhD

Missed the Contra Cruise?

Click here for what it was like, and to sign up for information on future cruises.

Need More Episodes?

Check out the Tom Woods Show, which releases a new episode every weekday. Become a smarter libertarian in just 30 minutes a day!