Ep. 58 Only Idiots Worry About the National Debt

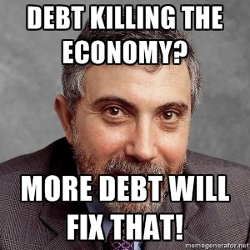

Krugman can’t believe people who worry about the national debt are taken seriously. There are no serious budgetary or financing problems on the horizon, so if there’s anything to be concerned about at all, that concern is surely misplaced today. Instead, we should be worried about climate change!

Krugman can’t believe people who worry about the national debt are taken seriously. There are no serious budgetary or financing problems on the horizon, so if there’s anything to be concerned about at all, that concern is surely misplaced today. Instead, we should be worried about climate change!

Krugman has things exactly backwards, as usual.

Krugman Column

“Debt, Diversion, Distraction” (October 22, 2016)

Contra Columns

“The Myth of ‘Morning in America’ — How the Public Debt Went from $1 Trillion to $35 Trillion in Four Decades, Part I,” by David Stockman

“Krugman’s Strange View About Planning for the Future,” by David R. Henderson

“Krugman Ignores IPCC on Climate Economics,” by Bob Murphy

Krugman vs. Krugman

“Errors and Emissions: Could Fighting Global Warming Be Cheap and Free?”

Need More Episodes?

Check out the Tom Woods Show, which releases a new episode every weekday. Become a smarter libertarian in just 30 minutes a day!