Ep. 44 Booming Stock Market Indicates Bad Times, Says Krugman

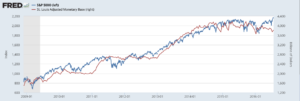

Is a rising stock market an indication of economic health? Not necessarily, says Krugman, and on that he’s of course correct. But what accounts for rising stock prices today? He says a lack of alternative options for investors — another way of saying the economy stinks, even though he devotes half his columns to defenses of Obama.

Is a rising stock market an indication of economic health? Not necessarily, says Krugman, and on that he’s of course correct. But what accounts for rising stock prices today? He says a lack of alternative options for investors — another way of saying the economy stinks, even though he devotes half his columns to defenses of Obama.

Krugman Column

“Bull Market Blues” (July 15, 2016)

Special Offers

Get three free issues of the Lara-Murphy Report, Bob Murphy’s financial publication! Click here.

Get a free, 22-lecture, non-government-worshiping course on the U.S. presidents from Tom’s Liberty Classroom at FreeHistoryCourse.com.

Related Column

“The Social Function of Stock Speculators,” by Bob Murphy

Related Data

Related Episodes

Ep. 43 Krugman Says Investors Have Given Up Hope…So, What Happened to that Obama Recovery, Paul?

Ep. 32 Why Antitrust Is the Problem, Not the Solution

The Contra Cruise

Join us October 9-16 for an unforgettable week at sea!

Need More Episodes?

Check out the Tom Woods Show, which releases a new episode every weekday. Become a smarter libertarian in just 30 minutes a day!