Ep. 32 Why Antitrust Is the Problem, Not the Solution

Krugman is now blaming poor economic times (but hasn’t he been trying to tell us things are much better than the stupid right-wingers say?) on a lack of competition. Lax antitrust enforcement is the problem! Sure it is. In fact, antitrust itself is the problem, as we show in this week’s episode.

Krugman is now blaming poor economic times (but hasn’t he been trying to tell us things are much better than the stupid right-wingers say?) on a lack of competition. Lax antitrust enforcement is the problem! Sure it is. In fact, antitrust itself is the problem, as we show in this week’s episode.

Krugman Column

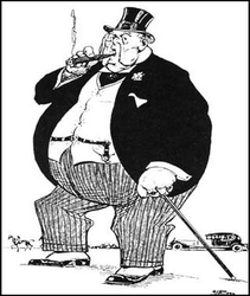

“Robber Baron Recessions” (April 18, 2016)

Special Offers

Get three free issues of the Lara-Murphy Report, Bob Murphy’s financial publication! Click here.

Get a free, 22-lecture, non-government-worshiping course on the U.S. presidents from Tom’s Liberty Classroom at FreeHistoryCourse.com.

Contra Columns

“The Antitrust Economists’ Paradox,” by Thomas J. DiLorenzo (PDF)

“‘Regime Uncertainty’: Why the Great Depression Lasted So Long and Why Prosperity Resumed After the War,” by Robert Higgs (PDF)

Article Mentioned

“The Misplaced Fear of “Monopoly”,” by Thomas E. Woods

Books Mentioned

The Myth of the Robber Barons: A New Look at the Rise of Big Business in America, by Burton Folsom

Antitrust and Monopoly: Anatomy of a Policy Failure, by Dominick Armentano

Event Mentioned

Mises Circle in Seattle, May 21, 2016

The Contra Cruise

Join us October 9-16 for an unforgettable week at sea!

Need More Episodes?

Check out the Tom Woods Show, which releases a new episode every weekday. Become a smarter libertarian in just 30 minutes a day!