Ep. 3 Trump Is Right About Economics, Says Krugman

Paul Krugman says Donald Trump is right to question supply-side orthodoxy about taxation of the wealthy. And Krugman says it’s a myth that cutting those taxes helps the economy.

Lots of great stuff in today’s episode: even Keynesian researchers disagree with Krugman; it’s not true that the job creation numbers under Obama are better than in the 1980s; and how Krugman can claim to be right no matter what happens.

Krugman Column

“Trump Is Right on Economics” (Sept. 7, 2015)

Contra Columns

“The Macroeconomic Effects of Tax Changes: Estimates Based on a New Measure of Fiscal Shocks,” by Christina D. Romer and David H. Romer

“Paul Krugman: Three Wrongs Don’t Make a Right,” by Bob Murphy

“Paul ‘Orwell’ Krugman Touts Job Growth in the Obama Recovery,” by Bob Murphy

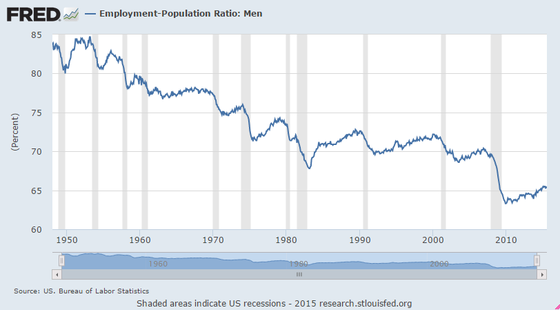

Graph: Employment-Population Ratio: Men

Related Episodes, Tom Woods Show

Ep. 473 Does the Economy Do Better Under the Democrats, and Has Obama Been Better Than Reagan?

Ep. 331 No, Progressives, Lower Taxes Rates on the Rich Don’t Wreck the Economy

Need More Episodes?

Check out the Tom Woods Show, which releases a new episode every weekday. Become a smarter libertarian in just 30 minutes a day!