Ep. 107 The Problems With Tax Reform

Play

Stop

Krugman complains that what we know so far about a potential Trump tax reform plan is not good — it would give most relief to millionaires and billionaires. We discuss Rand Paul’s opposition to the plan, and what genuine tax reform should really do.

Krugman complains that what we know so far about a potential Trump tax reform plan is not good — it would give most relief to millionaires and billionaires. We discuss Rand Paul’s opposition to the plan, and what genuine tax reform should really do.

Krugman Column

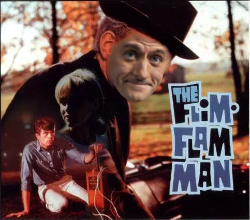

“Republicans, Trapped by Their Flimflam” (October 3, 2017)

Contra Columns

“How Draconian Is the Ryan Plan?,” by Bob Murphy

“The Macroeconomic Effects of Tax Changes: Estimates Based on a New Measure of Fiscal Shocks,” by Christina Romer and David Romer

Video Discussed

Episode Mentioned

Ep. 1001 Rothbard on Strategy: Need We Abandon Principle to Be Successful?

Need More Episodes?

Tom and Bob have their own podcasts! Check out the Tom Woods Show and the Lara-Murphy Report.